Introduction to Forex: What is Forex Trading, and Why Does it Matter?

Forex trading, often referred to simply as “Forex” or “FX,” is the world’s largest and most liquid financial market. It involves the buying and selling of currencies with the goal of making a profit. But why should you care about Forex trading? In this forex trading guide, you are going to understand why this market is such a big deal.

*check out WolfX premium forex signals to get a proper starting to your trading journey*

What is Forex Trading?

At its core, Forex trading is the exchange of one currency for another. You’ve probably done this if you’ve ever traveled abroad and exchanged your local currency for foreign money. Forex trading takes this concept to the next level by allowing you to profit from fluctuations in exchange rates. The Forex market operates 24 hours a day, five days a week, and involves a vast network of banks, financial institutions, corporations, governments, and individual traders like you.

The market is decentralized, meaning that there is no central exchange like the stock market. Instead, trading takes place over-the-counter (OTC) through a global network of computers. This makes Forex trading highly accessible—you can trade from anywhere with an internet connection, and all you need is a reliable trading platform to get started.

Why Does Forex Trading Matter?

Now that you know what Forex trading is, you might be wondering why it matters, especially to you. Well, Forex trading offers unique opportunities that other financial markets simply can’t match. First and foremost, the Forex market is incredibly liquid. This means that you can enter and exit trades quickly, often in seconds, without worrying about not finding a buyer or seller. This high liquidity is due to the massive daily trading volume, which exceeds $6 trillion, making it the most traded market in the world.

Another reason Forex trading matters is the potential for profit in both rising and falling markets. Unlike stock trading, where you typically only profit when the market goes up, Forex trading allows you to profit whether the market is bullish or bearish. You can buy a currency pair if you believe the base currency will strengthen against the quote currency, or sell if you think it will weaken. This flexibility provides you with more opportunities to make money, regardless of market conditions.

Accessibility and Low Entry Barriers

Forex trading is also appealing because of its accessibility and relatively low entry barriers. Unlike other financial markets, you don’t need a large amount of capital to start trading Forex. Many brokers offer the ability to trade with leverage, meaning you can control a large position with a small amount of money. This is a double-edged sword, however, as it amplifies both potential gains and potential losses. But for those with a solid forex trading guide and a good risk management strategy, the possibilities are endless.

Moreover, the Forex market is open 24 hours a day during the workweek, allowing you to trade whenever it fits your schedule. Whether you’re a night owl or an early bird, there’s always an opportunity to trade. This is particularly beneficial for young professionals who may have other commitments during the day. You can trade before or after work, or even during your lunch break. The flexibility of the Forex market makes it possible to fit trading into your life, rather than the other way around.

The Global Impact of Forex

Lastly, Forex trading matters because it plays a crucial role in the global economy. It’s not just about making money; it’s about understanding and participating in the dynamics of global trade. Every time you trade Forex, you’re engaging with the broader economic forces at play—whether it’s a central bank making a policy decision, a multinational corporation hedging currency risk, or geopolitical events causing market volatility.

By trading Forex, you’re not only tapping into a market with vast potential, but you’re also gaining insight into how the world works. This knowledge can be empowering, giving you a broader perspective on global financial markets and how they interact with each other.

Key Terminology: Essential Terms Every Beginner Should Know

If you’re just getting started with Forex trading, the jargon can feel overwhelming. But don’t worry! Understanding the key terminology is the first step toward becoming confident in this exciting market. Let’s break down some of the most important terms you’ll encounter, so you can navigate your forex trading guide with ease.

Currency Pair

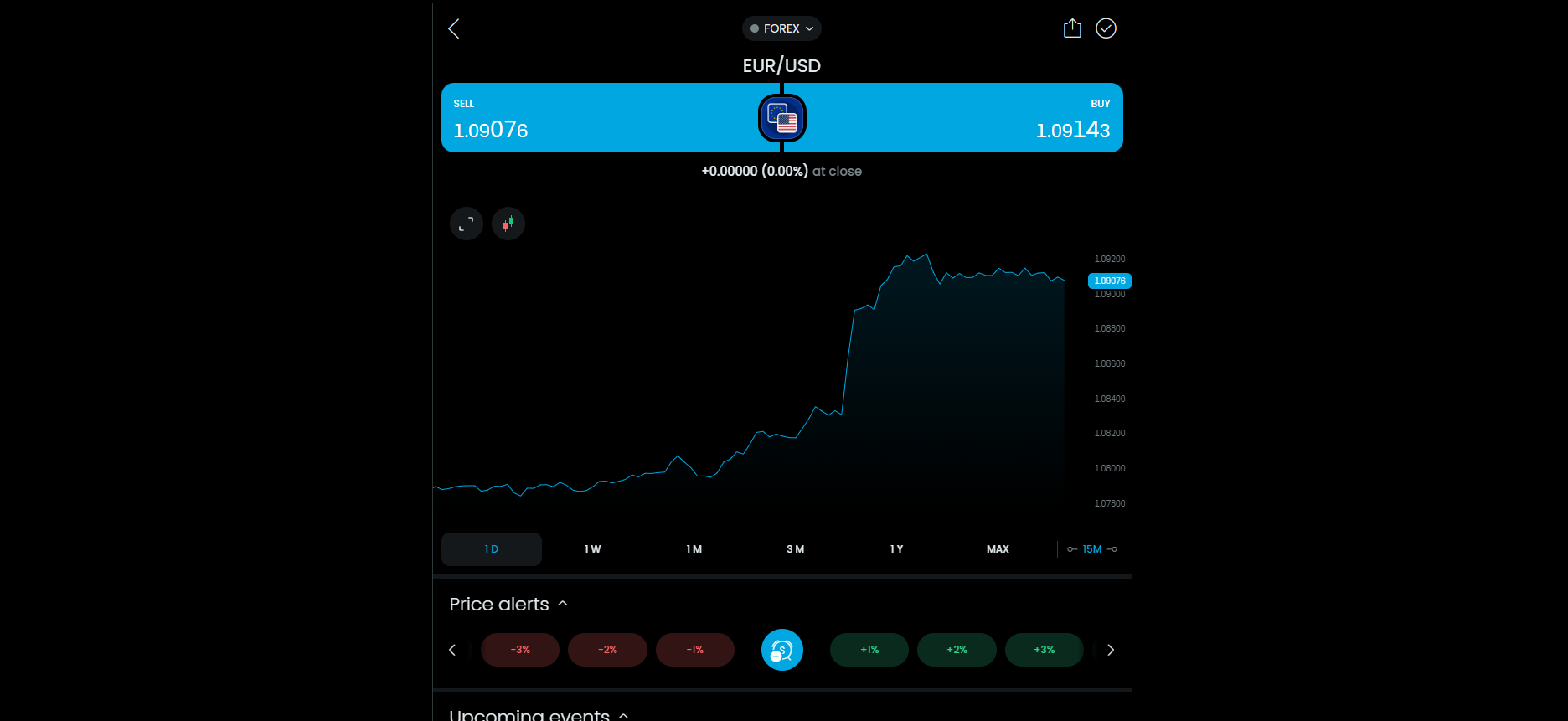

In Forex trading, you’ll hear a lot about currency pairs. Simply put, a currency pair is the quotation of two different currencies. The value of one currency is quoted against the other. For example, in the EUR/USD pair, the euro (EUR) is the base currency, and the US dollar (USD) is the quote currency. If the EUR/USD is trading at 1.20, it means one euro is equal to 1.20 US dollars. Understanding how currency pairs work is crucial because all Forex trades involve buying one currency while selling another.

Pips

You’ll often come across the term “pip” in Forex trading. A pip, or “percentage in point,” is the smallest price move that a given exchange rate can make. For most currency pairs, a pip is equal to 0.0001, or one-hundredth of a percent. It might seem like a tiny amount, but since trades are typically large, even small movements can add up. Think of pips as the building blocks of your profits or losses. Mastering how pips work will help you track your trades more accurately.

Spread

The spread is another essential term you’ll need to know. It’s the difference between the bid price (the price at which you can sell a currency) and the ask price (the price at which you can buy it). The spread is how brokers make money, and it’s a key factor to consider when choosing a broker. A lower spread means lower trading costs, which can make a big difference, especially if you’re a frequent trader. Always keep an eye on the spread, as it can vary depending on market conditions and the currency pair you’re trading.

Leverage

Leverage is a powerful tool in Forex trading, but it comes with risks. Leverage allows you to control a large position with a relatively small amount of capital. For example, with 100:1 leverage, you can control $10,000 worth of currency with just $100. While leverage can amplify your profits, it can also magnify your losses. It’s important to use leverage wisely and always consider the potential risks. A good forex trading guide will emphasize the importance of responsible leverage use.

Margin

Margin goes hand-in-hand with leverage. It’s the amount of money you need to open and maintain a leveraged position. When you open a trade, a portion of your account balance is set aside as margin. This ensures that you have enough funds to cover potential losses. If your trade moves against you and your margin level drops too low, your broker may issue a margin call, requiring you to deposit more funds or close your position. Understanding margin is crucial to managing your risk effectively.

Lot

A “lot” is the standard unit size for a Forex transaction. There are three main types of lots: standard, mini, and micro. A standard lot is 100,000 units of the base currency, a mini lot is 10,000 units, and a micro lot is 1,000 units. The size of the lot you trade will depend on your account size and risk tolerance. Trading smaller lots can help you manage your risk better, especially when you’re just starting out. As you become more comfortable, you can gradually increase your lot size.

Long and Short Positions

In Forex, you’ll often hear about going “long” or “short.” A long position is when you buy a currency pair, expecting the base currency to rise in value. A short position is when you sell a currency pair, expecting the base currency to fall in value. Being able to take both long and short positions gives you the flexibility to profit in both rising and falling markets. This is one of the advantages of Forex trading, and understanding these terms is essential for executing your trades effectively.

Stop Loss and Take Profit

These are two critical terms for managing risk and securing profits. A stop loss is an order to close a trade when it reaches a certain price level, limiting your potential loss. A take profit order does the opposite—it closes the trade when your profit target is reached. Setting stop loss and take profit levels is a key part of any trading strategy, as they help you manage risk and lock in gains. A solid forex trading guide will always stress the importance of using these tools to protect your capital.

Liquidity

Liquidity refers to how easily an asset can be bought or sold in the market without affecting its price. In the Forex market, liquidity is high, meaning that you can easily enter and exit trades. High liquidity ensures that you can trade large amounts without significant price changes. This is one of the reasons why Forex is so popular among traders. However, liquidity can vary between different currency pairs and during different times of the day, so it’s something to be mindful of when planning your trades.

Market Hours: Understanding When to Trade for Maximum Profits

Forex trading might seem like a 24/7 opportunity, but not all hours are created equal. Knowing when to trade can make a big difference in your profits. The Forex market is divided into four major trading sessions: Sydney, Tokyo, London, and New York. Each of these sessions offers unique opportunities, and understanding the best times to trade can give you a significant edge. Let’s dive into the details to help you maximize your trading potential with this essential part of any forex trading guide.

The Forex Market: A Global Playground

The Forex market is truly global, with trading happening around the clock as different markets open and close across time zones. This continuous nature of Forex trading is both an advantage and a challenge. On the one hand, you can trade whenever it suits you. On the other hand, certain times offer better trading opportunities due to increased market activity. The key is knowing when these peak times occur, so you can take advantage of higher liquidity and tighter spreads.

The London Session: The Powerhouse of Forex

The London session is often considered the most important in Forex trading. It overlaps with both the Tokyo and New York sessions, making it the busiest and most liquid time of the day. Most major currency pairs, especially those involving the euro, pound, and Swiss franc, see significant movement during this session. If you’re looking to trade with tighter spreads and greater volatility, the London session is where you want to be. A good forex trading guide will always highlight the importance of this session, especially for traders focusing on European currencies.

The New York Session: The Home Stretch

As the London session starts to wind down, the New York session picks up the baton. This session is particularly crucial for trading USD pairs, as it accounts for nearly 85% of all Forex trades involving the US dollar. The New York session is known for its volatility, especially when it overlaps with the London session. During this overlap, you’ll find some of the best trading opportunities due to the high volume of trades. However, once the London session closes, the market can become more unpredictable, so it’s essential to stay alert.

The Tokyo Session: A Quiet Storm

While the Tokyo session might not be as volatile as the London or New York sessions, it still offers valuable trading opportunities, especially for currency pairs involving the yen. The Tokyo session sets the tone for the day and often influences the direction of the following sessions. If you prefer a more stable and less volatile market, trading during the Tokyo session might suit you. However, keep in mind that this session is typically quieter, with lower liquidity and wider spreads.

Sydney Session: The Warm-Up Act

The Sydney session is the first to open each week, kicking off the Forex trading week. While it’s the smallest and least volatile session, it’s essential for traders focusing on AUD and NZD pairs. The Sydney session can also provide early insights into how the market might behave in the coming sessions. If you’re just starting out or looking to ease into the trading week, the Sydney session offers a more relaxed trading environment. It’s a good time to plan your strategy and get ready for the more intense sessions ahead.

The Overlaps: Where the Magic Happens

One of the most critical aspects of Forex trading is understanding the overlaps between major sessions. The two most significant overlaps are between the London and New York sessions and the London and Tokyo sessions. These overlaps see the highest trading volumes and offer the best opportunities for making profits. During these times, you’ll find tighter spreads and greater market liquidity, making it easier to enter and exit trades at favorable prices. If you’re looking to maximize your profits, targeting these overlap periods is a smart strategy.

Adapting to Your Schedule

While it’s essential to know the best market hours for trading, it’s equally important to adapt them to your personal schedule. Not everyone can trade during the peak hours of the London or New York sessions, and that’s okay. The beauty of Forex trading is its flexibility. You can find opportunities in every session, as long as you understand the market dynamics at play. Whether you’re an early bird or a night owl, there’s a trading session that fits your lifestyle.

Demo Trading: The Benefits of Practicing Before Going Live

Before you jump into live forex trading, there’s a valuable step that can save you a lot of stress and potential losses—demo trading. Demo trading allows you to experience the forex market in real-time, but without risking any of your hard-earned money. It’s like having a practice round before the real game, giving you the confidence and skills you need to succeed when it matters most. In this section of our forex trading guide, we’ll explore why demo trading is essential and how it can set you up for success in the fast-paced world of forex trading.

*Practice demo trading on www.trading212.com ‘s easy-to use interface*

Learn the Basics Without the Pressure

One of the biggest benefits of demo trading is that it gives you the chance to learn the basics of forex trading without the pressure of losing money. When you’re starting out, the forex market can seem overwhelming, with its complex charts, indicators, and terminology. A demo account lets you get comfortable with these tools in a risk-free environment. You can experiment with different strategies, understand how the market moves, and learn to read charts—all without the fear of making a costly mistake. This way, you build a strong foundation of knowledge and skills that will serve you well when you transition to live trading.

Test and Refine Your Strategies

Even experienced traders use demo accounts to test and refine their strategies. The forex market is constantly changing, and what worked last week might not work today. A demo account allows you to test new strategies under real market conditions, but without any financial risk. You can see how different approaches perform over time and make adjustments as needed. This process of trial and error is crucial for developing a strategy that works for you. Whether you’re testing a new indicator, experimenting with different timeframes, or fine-tuning your risk management, a demo account gives you the freedom to do so without consequences.

Build Confidence and Discipline

Confidence and discipline are key components of successful trading, and a demo account is the perfect place to develop these traits. In the beginning, it’s easy to get caught up in the excitement of trading and make impulsive decisions. Demo trading helps you practice sticking to your strategy and maintaining discipline, even when emotions are running high. By trading in a simulated environment, you build the confidence to follow through on your plan without second-guessing yourself. You also learn to manage your emotions, which is crucial when trading real money. The discipline and confidence you gain from demo trading will be invaluable when you start trading live.

Understand Risk Management

Risk management is one of the most important aspects of forex trading, and it’s something you can practice extensively with a demo account. In a demo environment, you can test different risk management techniques, such as setting stop-loss orders, calculating position sizes, and managing leverage. You can see how these tools affect your trading results and learn to use them effectively. By practicing risk management in a demo account, you develop a deep understanding of how to protect your capital when you go live. This knowledge can make the difference between a successful trader and one who struggles to stay afloat.

Develop Your Trading Routine

Another benefit of demo trading is that it allows you to develop a trading routine that fits your lifestyle. Successful trading requires consistency, and having a routine can help you stay focused and disciplined. With a demo account, you can experiment with different routines, such as trading at specific times of the day or following a particular analysis process. You can also practice using your trading platform, so you’re comfortable with all the tools and features before you start trading live. By developing a routine in a demo environment, you’re better prepared to stick to it when real money is on the line.

Transition Smoothly to Live Trading

The ultimate goal of demo trading is to prepare you for live trading, and a well-executed demo phase can make this transition much smoother. When you’ve spent time practicing with a demo account, you’re more familiar with the market, more confident in your strategy, and more disciplined in your approach. This makes the switch to live trading less daunting. You’ve already experienced the ups and downs of trading in a risk-free environment, so you know what to expect. Of course, live trading comes with its own set of challenges, but your demo experience will give you a solid foundation to build on.