What is Forex Trading?

Forex trading, short for foreign exchange trading, is the process of buying and selling currencies to make a profit. Imagine you’re planning a trip to Europe. You exchange your dollars for euros at the bank. The rate at which you exchange these currencies is the forex rate. Forex traders do this on a much larger scale, aiming to profit from fluctuations in currency values. It’s like a gigantic global marketplace where currencies are the goods, and traders are the buyers and sellers.

How Does Forex Trading Work?

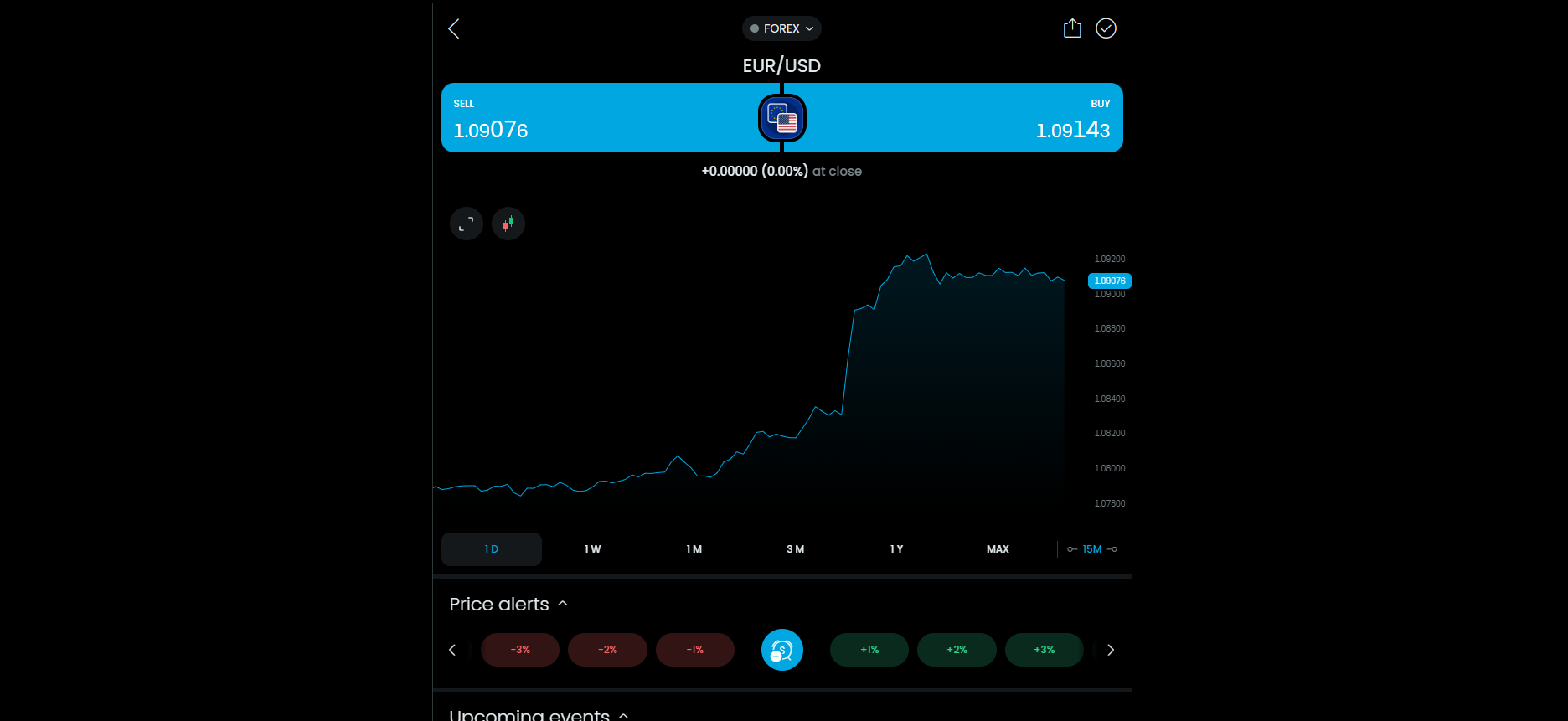

Forex trading might sound complex, but it’s quite simple once you get the hang of it. You trade currency pairs, which means you’re always buying one currency while selling another. For example, if you think the euro will rise against the dollar, you buy the EUR/USD pair. If the euro indeed strengthens, you can sell the pair at a higher price and pocket the difference. It’s all about predicting which currency will go up or down relative to another.

Forex markets are decentralized and operate 24 hours a day, five days a week. This round-the-clock nature means you can trade almost anytime you want, fitting around your schedule. The market opens on Sunday evening and closes on Friday night, offering ample opportunity for trading whenever it suits you. This flexibility is one of the many reasons why forex trading is so appealing to busy professionals.

Why Trade Forex?

You might wonder why you should dive into forex trading when there are other investment options out there. Forex trading offers several unique advantages. Firstly, it’s highly liquid, meaning you can buy and sell currencies quickly without waiting for buyers or sellers. This high liquidity ensures that you can enter or exit trades smoothly, even with large amounts of money.

Moreover, forex trading allows you to leverage your investments, meaning you can control a large position with a relatively small amount of money. This leverage can amplify your profits but remember, it can also magnify your losses, so it’s important to manage your risk wisely. Additionally, forex markets offer opportunities to profit in both rising and falling markets, providing you with the flexibility to trade in various market conditions.

Getting Started with Forex Trading

Starting your forex trading journey might seem daunting, but don’t worry, it’s easier than you think. The first step is to learn the basics. Understanding how the forex market works, familiarizing yourself with currency pairs, and knowing how to read forex quotes are essential. You don’t need to be a financial wizard; just a bit of dedication and willingness to learn will go a long way.

Once you have a basic understanding, it’s time to choose a reliable forex broker. Look for brokers that offer user-friendly platforms, low fees, and strong customer support. Many brokers offer demo accounts where you can practice trading with virtual money. These demo accounts are a great way to get comfortable with trading without risking your hard-earned cash.

*check out these brokers*

Tools and Resources

In today’s digital age, you have access to countless tools and resources to help you succeed in forex trading. Forex signal groups, like the one offered at incomecoach.online, provide valuable insights and trading signals to guide your trades. These signals are generated by experienced traders and can help you make informed decisions. It’s like having a team of experts by your side, sharing their knowledge and strategies.

There are also numerous educational resources available online. From webinars and tutorials to blogs and forums, you can find plenty of material to deepen your understanding of forex trading. Participating in trading communities can also be beneficial. You can exchange ideas, learn from other traders, and stay updated with the latest market trends.

Staying Motivated and Confident

Forex trading can be exciting, but it also requires patience and perseverance. It’s normal to face challenges and setbacks along the way. Staying motivated and confident is key to long-term success. Set realistic goals and celebrate your progress, no matter how small. Remember, every successful trader started as a beginner, just like you.

Surround yourself with a supportive community. Being part of a trading group can provide motivation, encouragement, and valuable insights. Share your experiences, learn from others, and keep pushing forward. Forex trading is a journey, and with the right mindset and resources, you can achieve your financial goals.

Essential Forex Trading Strategies

Understanding Strategies

When it comes to forex trading, having a strategy is crucial. Think of it as your game plan, guiding you through the market’s ups and downs. Without a strategy, you’re like a ship sailing without a compass, drifting aimlessly. A solid forex trading strategy helps you make informed decisions, manage risks, and maximize profits. It’s about finding what works for you and sticking to it.

There are various strategies out there, each with its own approach and methodology. The key is to understand a few and see which ones align with your trading style and goals. Remember, no strategy guarantees success every time, but having a plan increases your chances of making profitable trades consistently.

Trend Following Strategy

One popular forex trading strategy is trend following. This strategy involves identifying the direction of the market and trading in that direction. The idea is simple: if the market is trending upwards, you buy; if it’s trending downwards, you sell. It’s like surfing a wave – you ride along with the momentum.

To implement a trend following strategy, you can use various tools and indicators. Moving averages are a common choice, helping you identify the overall trend direction. When the price is above the moving average, it indicates an upward trend, and when it’s below, a downward trend. Another useful tool is the trendline, which connects the highs in a downtrend or the lows in an uptrend, giving you a visual guide to the market’s direction.

Breakout Strategy

Another exciting strategy is the breakout strategy. This strategy focuses on identifying key levels where the price is likely to break out, leading to significant movements. Breakouts occur when the price moves beyond a specific level of support or resistance, indicating the start of a new trend. It’s like waiting for a dam to burst and then riding the flow.

To effectively use the breakout strategy, you need to identify these critical levels. Support and resistance levels are areas where the price has historically struggled to move past. When the price breaks through these levels, it often continues in that direction for a while. You can also use technical indicators like Bollinger Bands or the Relative Strength Index (RSI) to identify potential breakout points.

Range Trading Strategy

If you prefer a more conservative approach, the range trading strategy might be for you. This strategy involves identifying key levels of support and resistance and trading within that range. It’s like playing ping-pong, where the price bounces between the support and resistance levels, and you trade accordingly.

To succeed with range trading, you need to accurately identify the range boundaries. Support levels are where the price tends to stop falling and bounce back up, while resistance levels are where the price tends to stop rising and fall back down. You buy at the support level and sell at the resistance level, aiming to profit from the price oscillating within the range.

Swing Trading Strategy

For those who like a mix of both short-term and long-term trading, swing trading offers a balanced approach. This strategy involves holding trades for several days to capture short- to medium-term market movements. Swing traders aim to capitalize on price swings, whether in an uptrend or downtrend.

Swing trading requires patience and a keen eye for market trends. You can use technical analysis tools like the Moving Average Convergence Divergence (MACD) or the Relative Strength Index (RSI) to identify potential entry and exit points. The goal is to enter the market at the start of a price swing and exit before it reverses, capturing a portion of the movement.

Scalping Strategy

If you thrive on quick, fast-paced action, the scalping strategy might be your go-to. Scalping involves making multiple trades throughout the day, aiming to profit from small price movements. It’s like being a market ninja, swiftly entering and exiting trades to capture tiny profits.

Scalping requires a lot of focus and discipline, as well as access to reliable and fast trading platforms. The goal is to make many small profits that add up over time. To succeed with scalping, you need to have a solid understanding of market behavior and be able to react quickly to price changes. Technical indicators like the Moving Average and Bollinger Bands can be helpful in identifying short-term trading opportunities.

Day Trading Strategy

Day trading is another popular strategy, perfect for those who can dedicate a significant amount of time to trading. This strategy involves opening and closing trades within the same day, taking advantage of intraday price movements. It’s like being a full-time trader, but with the flexibility to close all positions by the end of the day.

Day trading requires a good understanding of market trends and the ability to make quick decisions. You can use a combination of technical analysis and real-time news updates to identify trading opportunities. The goal is to profit from the daily fluctuations in currency prices, avoiding overnight risks.

Combining Strategies

Sometimes, combining multiple strategies can give you a more comprehensive approach to forex trading. For example, you might use a trend following strategy to identify the overall market direction, and then apply a breakout strategy to pinpoint entry points. Or, you could use swing trading for your long-term trades while scalping for short-term profits.

The key is to find a balance that works for you and aligns with your trading goals. Experiment with different strategies, track your results, and adjust your approach as needed. Remember, the most successful traders are those who continuously learn and adapt to the ever-changing market conditions.

The Importance of Reliable Trading Signals

Understanding Trading Signals

When it comes to forex trading, reliable trading signals are like your guiding star. They help you navigate the complex and often turbulent waters of the forex market. But what exactly are trading signals? Simply put, trading signals are recommendations or alerts for entering or exiting a trade based on specific market conditions. These signals can be generated by human analysts or automated trading systems. They are essential for traders who want to make informed decisions without spending hours analyzing charts and data.

Enhancing Your Decision-Making

Imagine you’re standing at a crossroads, unsure of which path to take. Reliable trading signals act like a GPS, directing you towards the most promising route. They take the guesswork out of trading by providing you with actionable insights and timely recommendations. This means you can make decisions quickly and confidently, even in volatile market conditions.

By using reliable trading signals, you can reduce the emotional stress that often accompanies trading. Instead of second-guessing your choices, you can trust the signals to guide you. This allows you to focus on other important aspects of your trading strategy, such as risk management and portfolio diversification.

Saving Time and Effort

Let’s face it, not everyone has the time or expertise to analyze the forex market in-depth. This is where reliable trading signals come to the rescue. They save you countless hours of research and analysis by providing you with ready-to-use trade recommendations. Whether you’re a busy professional or a part-time trader, these signals help you make the most of your limited time.

Reliable trading signals also keep you informed about market trends and opportunities, even when you’re not actively monitoring the market. This means you won’t miss out on potential trades, and you can act swiftly when opportunities arise. In essence, trading signals help you stay ahead of the game without putting in endless hours of work.

Boosting Your Confidence

Confidence is key in forex trading, and reliable trading signals can significantly boost your trading confidence. Knowing that your trading decisions are backed by expert analysis or sophisticated algorithms gives you peace of mind. This confidence can lead to more decisive actions and better trading outcomes.

When you trust your trading signals, you’re less likely to be swayed by market noise or irrational fears. This helps you stick to your trading plan and avoid impulsive decisions that could harm your portfolio. Over time, this disciplined approach can lead to more consistent and profitable trading results.

Improving Your Trading Skills

Using reliable trading signals doesn’t just benefit your trades; it also enhances your overall trading skills. By following and analyzing these signals, you can learn more about market patterns, technical indicators, and trading strategies. This continuous learning process helps you become a more knowledgeable and skilled trader.

You’ll start to notice how certain signals correspond with specific market movements, giving you deeper insights into the forex market. This knowledge can be invaluable, especially when you’re developing your own trading strategies or adjusting your current approach. In the long run, this makes you a more independent and confident trader.

Minimizing Risks

Every trader knows that risk is an inherent part of forex trading. However, reliable trading signals can help you manage and minimize these risks. By providing you with well-researched trade recommendations, these signals help you avoid potentially risky trades and focus on safer opportunities.

Many reliable trading signals come with additional information such as stop-loss levels and take-profit targets. This helps you set predefined exit points for your trades, reducing the chances of significant losses. In essence, trading signals help you create a more structured and disciplined approach to risk management.

Access to Expert Analysis

One of the biggest advantages of using reliable trading signals is gaining access to expert analysis. These signals are often generated by experienced traders or sophisticated algorithms that analyze various market factors. This means you’re benefiting from the expertise and insights of professionals without having to pay exorbitant fees.

Whether you’re a novice trader or an experienced one, having access to expert analysis can significantly improve your trading outcomes. It’s like having a seasoned mentor guiding you through the complexities of the forex market, helping you make smarter and more informed decisions.

Staying Updated with Market Trends

The forex market is constantly evolving, and staying updated with the latest trends is crucial for success. Reliable trading signals keep you informed about the latest market developments, ensuring you don’t miss out on new opportunities. This real-time information helps you stay agile and responsive to market changes.

By staying updated with market trends, you can adapt your trading strategy to current conditions. This flexibility is essential in the fast-paced world of forex trading, where market dynamics can change rapidly. Reliable trading signals ensure you’re always in the loop, ready to seize new opportunities as they arise.

Building a Support Network

Trading can sometimes feel like a solitary endeavor, but using reliable trading signals can help you build a support network. Many trading signal services come with access to trading communities or forums where you can interact with other traders. This sense of community provides valuable support, insights, and shared experiences.

Being part of a trading community helps you stay motivated and committed to your trading goals. You can learn from others’ successes and mistakes, exchange tips and strategies, and even find mentorship opportunities. This collaborative environment can significantly enhance your trading journey and contribute to your overall success.